China’s “Great Reversal”

Beijing goes from provider to extractor

A new era

Welcome to The Insider newsletter! (formerly known as Aftershocks). We’ll continue to deliver the same incisive, world class analysis and commentary, just under a new name. With change comes opportunity: You can now join the conversation by clicking on the comment button at the bottom of the page. We want to hear your perspective!

That’s not the only exciting news. At ONE Data, we’re pursuing an ambitious agenda to make development finance an easily accessible public good. To learn more, see our white paper. As part of that vision, we’ve just announced the “Development Finance Observatory,” a $4 million collaboration with Google.org and The Rockefeller Foundation. Launching this year, this first-of-its-kind, interactive data collaboration will improve the accessibility of development finance data and reduce data fragmentation. That will help collapse the time between data and insight, enabling finance ministers, journalists, investors, and analysts to follow the money by asking natural language questions.

Today, with technical infrastructure support from Google’s Data Commons and produced by ONE Data, we launched a new analysis, which discovered a “Great Reversal” in Chinese finance to developing countries. Below, we highlight a few of the key takeaways.

— Joe Kraus, Editor of The Insider and Senior Policy Director at ONE Data

3 things to know

1. Net flows to low- and middle-income countries have declined by 25%. That’s when comparing flows for the period 2010-14 with 2020-24. Rising debt service payments have consumed an ever-larger share of gross inflows.

Why it matters: For the last few years, developing countries have been spending more money on debt repayments to official and private lenders than they are receiving in new loans. Investments in official development assistance have kept most countries above water. With countries like the US, France, Germany, and the UK announcing drastic cuts to development assistance—at least 23% by 2027—low- and middle-income countries will struggle to access the affordable capital needed to stay afloat.

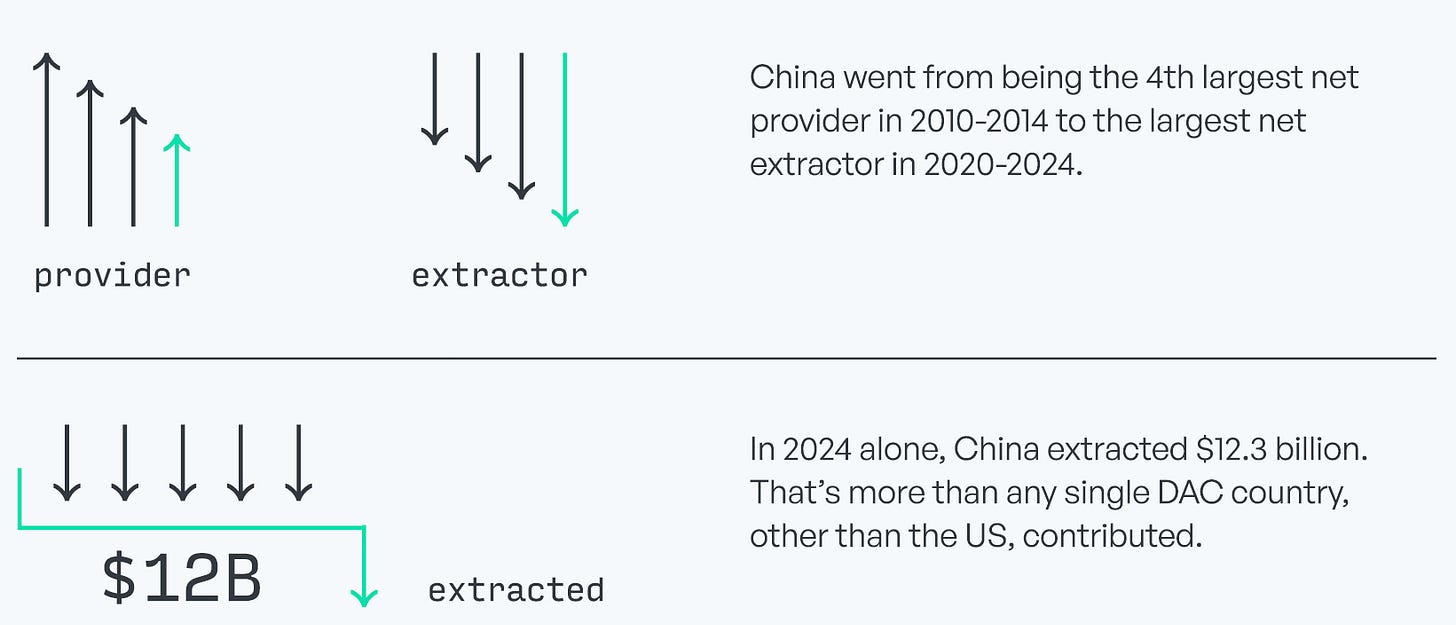

2. Chinese finance has undergone a “Great Reversal.” China went from being a net provider of finance—transferring $48 billion to low- and lower-middle-income countries a decade ago—to a net extractor of $24 billion. Africa has experienced the most dramatic reversal: It went from receiving $30 billion to paying out $22 billion, a $52 billion swing.

The “Great Reversal” of Chinese finance

Source: ONE Data

Why it matters: Developing country governments are increasingly facing the reality of financing health, education, and infrastructure spending from domestic budgets. Some countries have the fiscal space to finance their domestic needs. But others are grappling with expensive debt service payments that threaten to cut into domestic spending. Dozens of countries are spending more to service debt than they spend on health or education.

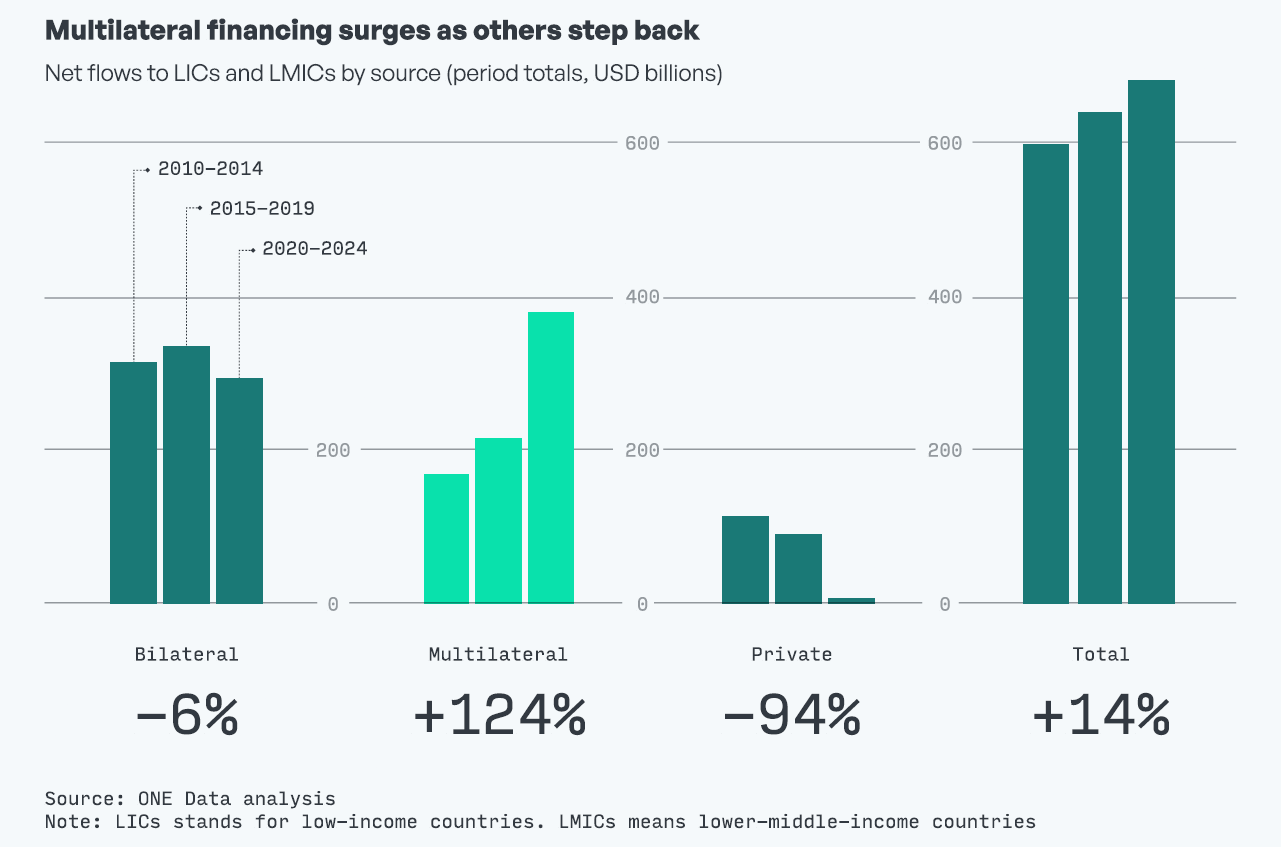

3. Multilateral providers now account for 56% of net flows. That’s up from 28% just a decade ago. Multilateral institutions—including multilateral development banks—have increased their financing by 124%. Private finance, on the other hand, has evaporated. It plummeted from $115 billion in net new resources over the 2010-14 period to only $7.3 billion in the last five years, and now accounts for just 1% of net finance flows.

Why it matters: The dominance in multilateral funding is likely to continue as bilateral flows continue to retreat. That may not be all bad: Developing country leaders say that multilateral providers are the most influential and helpful, according to a 2024 survey. But at a time of declining bilateral aid, the precipitous drop in private sector finance is concerning.

FROM THE ONE DATA TEAM:

Press release: Google.org, ONE Data, and The Rockefeller Foundation to launch new Development Finance Observatory in 2026.

Report: The Great Reversal: Multilaterals step up finance to developing countries as China steps back.

White paper: Reimagining how evidence drives change.

Media: ONE Data’s insights featured in African Business.

Media: David McNair spoke to Al Jazeera about Greenland, AI, and progress on poverty and hunger.

Analysis: David McNair on the need for institutional reform and strategic clarity in global development.

IN THE QUEUE:

Adapt, shrink or die: the global crisis in humanitarian aid.

Afreximbank cuts ties with Fitch over rating cut.

Is the “Board of Peace” a threat to international cooperation?

ONE Data provides cutting edge data, tools, and analysis so that we can fight together for a more just world. See for yourself.

This article comes at the perfect time, truely insightful work! I'm curious: what if this "Great Reversal" accelerates? Could we see a complete paradigm shift in how global development finance operates? It makes you wonder about the ripple effects for all low-income countries.