Tax avoided to death

It's a taxing problem

Originally published on 5 December 2025.

Taxing problems

We live in an era of extreme inequality. The world’s 10 richest men—and yes, they are all men—own more than the bottom 3.1 billion people.

If that weren’t bad enough, avoiding taxes—a key source of government revenue—has become its own industry. Multinational corporations and wealthy individuals are avoiding taxes—often through technically legal means—at an alarming rate.

Meanwhile, lower-income countries are struggling to find the revenues needed to provide basic services. High-income countries are pointing to their own revenue challenges to defend aid cuts.

One solution for both groups of countries: Close tax loopholes. Doing so would raise hundreds of billions of dollars in revenues annually, as we outline below.

— Joe Kraus, Aftershocks Editor

3 things to know

1. Countries lose an estimated $492 billion in tax a year to global tax abuse. 71% of that is due to tax abuse by multinational corporations; 29% is lost to offshore tax evasion by wealthy individuals.

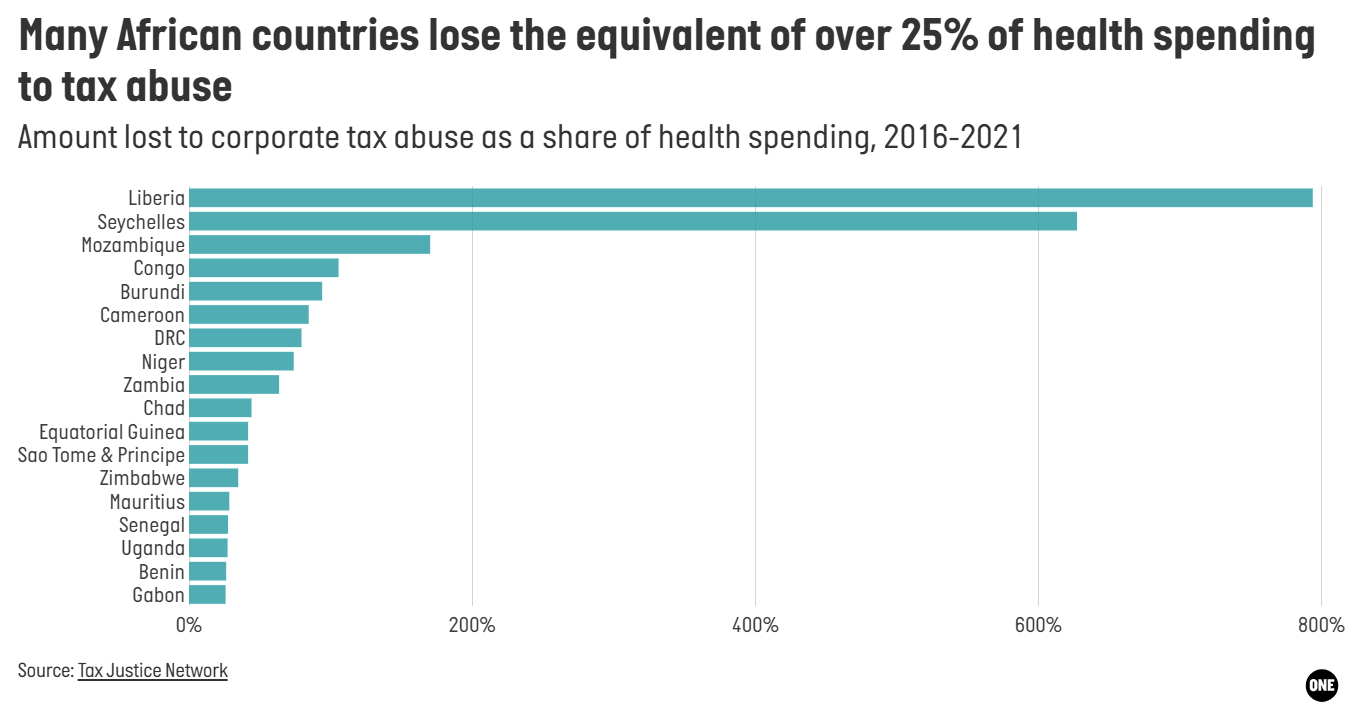

Why it matters: The tax losses for higher-income countries are greater in absolute terms, but lower-income countries’ losses account for a greater share of their budgets. For example: lower-income countries lose five times as much as higher-income countries as a share of public health budgets. Africa lost an amount equivalent to 53% of health spending between 2016 and 2021 due to corporate tax abuse; that’s nearly 20 points higher than the global average. That means countries have far less money to spend on social services or their energy transitions than they otherwise would. Ultimately, their citizens pay the price.

Explore an interactive version of the chart

2. 33 lower-income countries are in—or at high risk of—debt distress. Debt service payments have increased substantially in the past decade, in part due to higher interest payments on private loans. 40% of the world’s population lives in countries that spend more on debt service than health or education.

Why it matters: High debt levels are, in part, a result of countries bringing in insufficient revenues. Case in point: Tax policies that favor corporations and the wealthy were a key driver of Sri Lanka’s 2022 debt default and economic crisis. Those policies also contributed to the country’s chronic underfunding of education and other public services. That’s a recurring problem across many lower-income countries trying to meet their debt obligations amidst revenue shortfalls.

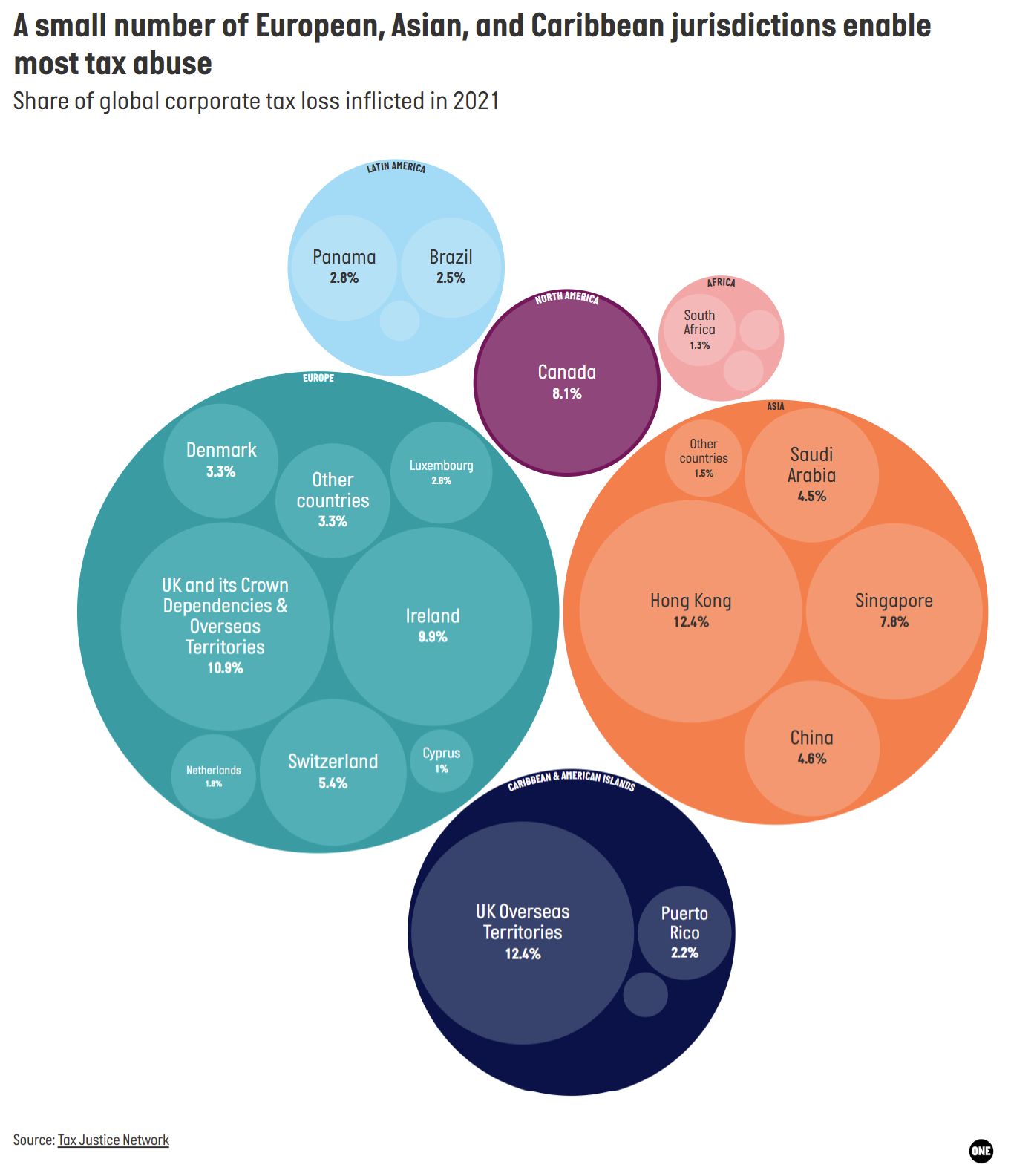

3. A handful of countries are to blame for the majority of corporate tax losses. Nearly three quarters of those losses flow into tax havens with low effective tax rates. That includes the UK and its Overseas Territories and Crown Dependencies (which account for 23% of global tax losses), Hong Kong (12.4%), Ireland (9.9%), Singapore (7.8%), and Switzerland (5.4%). For every $1 that corporations shift into tax havens, they avoid paying $5 in taxes, on average, to governments where the actual business activities take place.

Explore an interactive version of the chart

Why it matters: Corporate tax abuse amounts to a massive transfer of wealth from governments to corporations and their shareholders, most of whom live in the world’s wealthiest countries. It has contributed to—and helps perpetuate—historically high levels of inequality. But momentum for reform is growing. The African Group at the UN is leading an effort to establish a UN tax convention to make the global tax system fairer. And efforts to improve transparency of tax payments—a vital first step to tax reform—are gaining steam.

FROM THE ONE TEAM:

We uncovered a hidden fragility in health spending.

ONE’s CEO Ndidi Okonkwo Nwuneli highlights six opportunities to strengthen Africa’s food and nutrition systems.

David McNair on the outcome of the 7th African Union–European Union Summit.

IN THE QUEUE:

The world is round, but our tax loopholes shouldn’t be.

How ultra-processed foods are reshaping diets in low- and middle-income countries.

2025 Goalkeepers report: We can’t stop at almost.

How many lives would be saved if Africa had other regions’ child mortality rates?

ONE Data provides cutting edge data, tools, and analysis so that we can fight together for a more just world. See for yourself.

Fascinating breakdown of how tax havens systematically extract resources from the developing world. The fact that Africa loses 53% of its health spending equivalent to corporate tax abuse really shows how this isnt just an accounting problem but a structural transfer of resources upward. I'd add that the concentration in UK territories and Ireland also highlights how legacy colonial relationships persist through financial architecture. The metric about $1 shifted yielding $5 in avoided taxes perfectly captures the multiplier effect of these arrangements.